Ameris Bancorp (ABCB)·Q4 2025 Earnings Summary

Ameris Bancorp Delivers Record 2025 as NIM Expansion Drives 16% EPS Growth

January 30, 2026 · by Fintool AI Agent

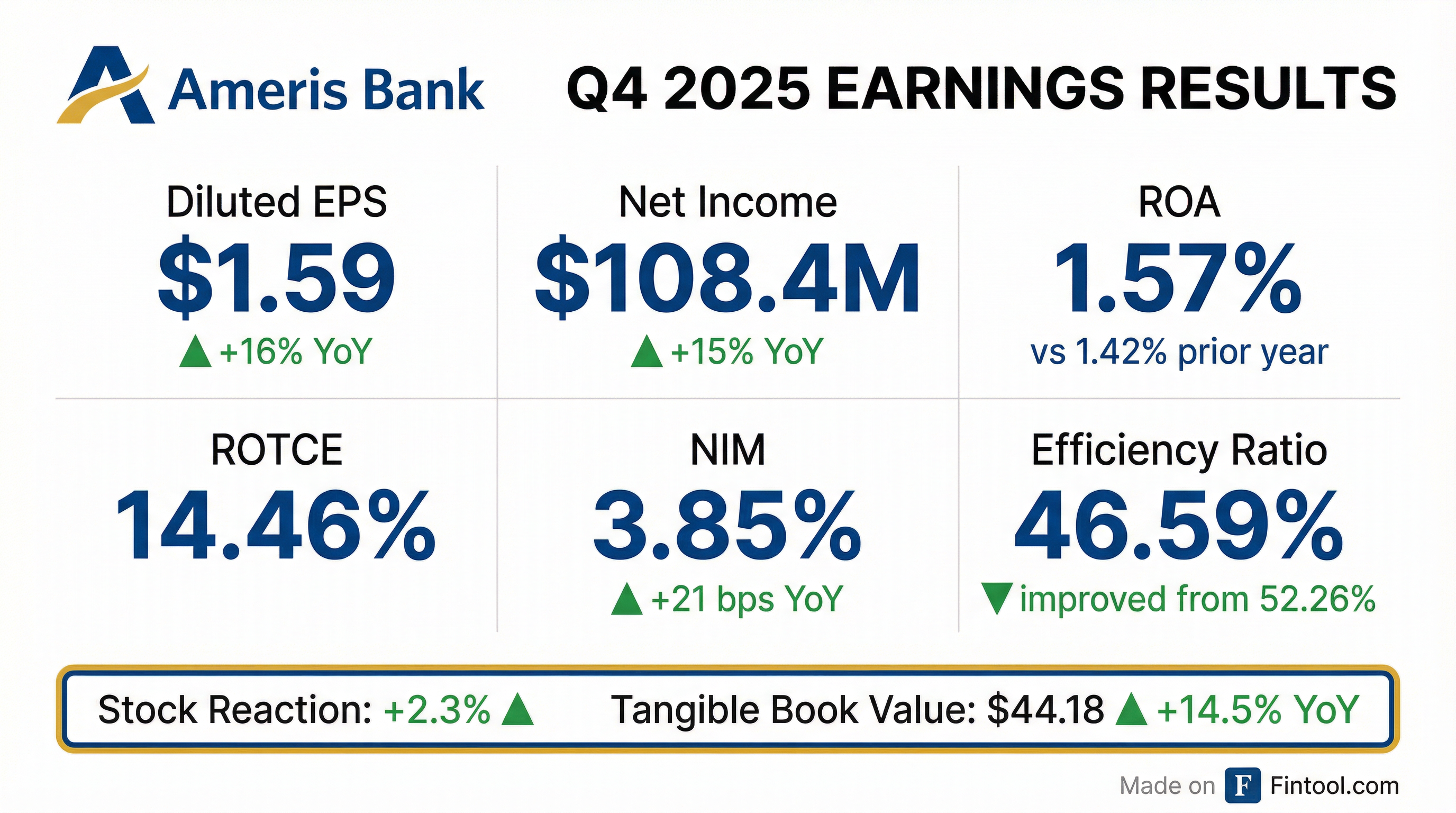

Ameris Bancorp (NYSE: ABCB) reported Q4 2025 diluted EPS of $1.59, up 16% year-over-year, capping off a record year with $412.2 million in net income. The Southeast regional bank delivered its fifth consecutive quarter of NIM expansion, reaching 3.85%, while driving efficiency ratio to an industry-leading 46.6%. Shares rose 2.3% on the initial release and traded flat following the earnings call.

Did Ameris Bancorp Beat Earnings?

Yes — Ameris delivered an EPS beat while revenue was essentially in line:

*Values retrieved from S&P Global

The full-year 2025 results set company records:

CEO Palmer Proctor highlighted the achievement:

"We reported record earnings for 2025 at over $412 million for the year, with our diluted EPS hitting $6 per share for the first time in our history. That's a 15% increase in EPS year-over-year, and we did it organically."

What Drove the Strong Quarter?

Net Interest Margin Expansion

NIM expanded 5 bps sequentially and 21 bps YoY to 3.85%. CFO Stokes noted 2 bps of the expansion came from the sub-debt payoff, with only 3 bps from loan and deposit dynamics.

Key drivers:

- Lower deposit costs — 10 bps positive impact from the funding side

- Subordinated debt payoff — Contributed 2 bps to margin expansion

- Loan production spread — New production at 6.35% blended yield vs 2% deposit cost = 4.35% accretive spread

Operating Efficiency Improvement

The efficiency ratio improved to 46.6% for Q4 and 50% for the full year, down from 53.2% in 2024. CFO Stokes cautioned this will normalize:

"I do anticipate the efficiency ratio to return above 50% in the first quarter, especially when you consider our seasonally heavy first quarter payroll taxes and 401(k) contributions."

The company delivered 6% revenue growth while expenses declined 1%, creating meaningful positive operating leverage.

How Did the Stock React?

ABCB shares rose 2.3% on the initial earnings release (January 29) to $81.30, trading near its 52-week high of $83.64. Following the earnings call on January 30, shares traded slightly lower at $81.09 (-0.3%), reflecting a muted reaction as the results were largely in line with expectations.

The modest pullback on the call day likely reflects the guidance for NIM compression, though the stock remains up 68% from its 52-week low and near all-time highs.

What Changed From Last Quarter?

Notable changes:

- Mortgage banking activity declined seasonally, with a heavier mix of wholesale production (less profitable than retail)

- Loan production hit highest levels since 2022 at $2.4B (+16% QoQ), with $500M+ CRE payoffs masking underlying strength

- Net charge-offs increased to 0.26% annualized from 0.14% in Q3, though full-year NCOs declined to 0.18%

Balance Sheet and Credit Quality

Capital Position

Ameris maintains robust capital ratios with significant buffers above regulatory minimums:

The company repurchased $40.8 million of stock in Q4 (563,798 shares) and $77.1 million for the full year. The board authorized a new $200 million buyback program in October 2025, with $159.2 million remaining.

Credit Quality

Credit metrics remain stable with ample reserve coverage:

Office portfolio exposure: Non-owner-occupied office loans totaled $1.37B (6.4% of loans) with 0% past due and 0% NPLs. Reserve coverage on investor office is 3.35%.

Segment Performance

The Banking Division was the primary driver, benefiting from NIM expansion and lower expenses. Retail Mortgage declined due to seasonal factors and compressed gain-on-sale margins, though the open pipeline of $701.9M suggests improving volumes ahead.

What Did Management Guide?

Management provided specific guidance during the Q&A:

Capital Targets

CEO Proctor outlined long-term capital targets during the Q&A:

"In terms of a target for us, I think we would be looking more at the TCE level, probably around 10, 10 and a half, and then on the CET1 target of around 12%."

With current TCE at 11.4% and CET1 at 13.2%, Ameris has significant excess capital for buybacks and organic growth.

Loan Production Dynamics

Q4 loan production of $2.4B was the highest since 2022, up 16% from Q3. However, elevated CRE payoffs of over $500M masked the underlying strength:

"Under normal CRE payoffs, our loan growth would have approached double digits."

Management expects payoffs to moderate in Q1 and Q2. New production came in at a blended yield of 6.35%, with deposit production at ~2%, generating a 4.35% accretive spread.

Q&A Highlights

On Market Disruption and Hiring

Analysts noted the "generational opportunity" from bank M&A disruption in the Southeast. Proctor explained Ameris's differentiated approach:

"We've been very fortunate with the level of talent that we have... We hired 21 lenders this year, but net-net, we were up 3. What we do is a constant view of looking at the talent, how it's progressing or not. We've been able to upgrade talent on a consistent basis."

On Deposit Competition and NIB Trends

CFO Stokes addressed the Q4 decline in non-interest bearing deposits:

"We had some customers—spread across 20-30 customers—that moved money out at the end of the year. Some of that, we believe, was used for some tax planning purposes... We've seen a lot of that come back in already."

The number of NIB accounts continued to increase, supporting the view that the decline was temporary seasonality rather than structural pressure.

On Premium Finance Outlook

When asked about the premium finance segment:

"Premium finance has been a good, steady, stable performer for us. It's not going to consume a lot more of the balance sheet, but what it will do is continue to provide meaningful earnings to the company on a go-forward basis."

On Buyback Philosophy

On capital deployment at elevated stock prices (up 15% from Q4 repurchase levels):

"A lot, the way we look at it, right or wrong, is if there was a mini Ameris Bank for sale out there, what would we be willing to pay for it? Who better to invest in than yourself. So we will still be selective there in terms of buyback opportunities."

On Treasury Management Success

Proctor highlighted investments in treasury management as a key deposit growth driver:

"A lot of people talk about lenders that they've hired. We like to focus on the deposit side and on the treasury side equally, if not more. I think that's been a big driver for us as we look forward into opportunities for good commercial deposit growth."

Key Takeaways

- Record profitability — FY 2025 net income of $412M (+15%) and EPS of $6.00 (+16%) demonstrate top-tier execution

- NIM compression ahead — Management guides 5-10 bps compression from 3.85% as deposit competition intensifies

- Best-in-class efficiency — 46.6% efficiency ratio significantly outperforms peers, though expected to normalize above 50% in Q1

- Strong capital position — TCE at 11.4% vs 10-10.5% target; CET1 at 13.2% vs 12% target gives room for buybacks

- Hidden loan growth strength — Production at $2.4B highest since 2022; elevated CRE payoffs masked underlying momentum

The quarter reinforces Ameris's position as one of the most profitable and well-managed regional banks in the Southeast.

Updated January 30, 2026 following earnings call

Related: ABCB Company Profile | Q3 2025 Earnings | Earnings Transcript